Central Bank tightens its monetary policy stance

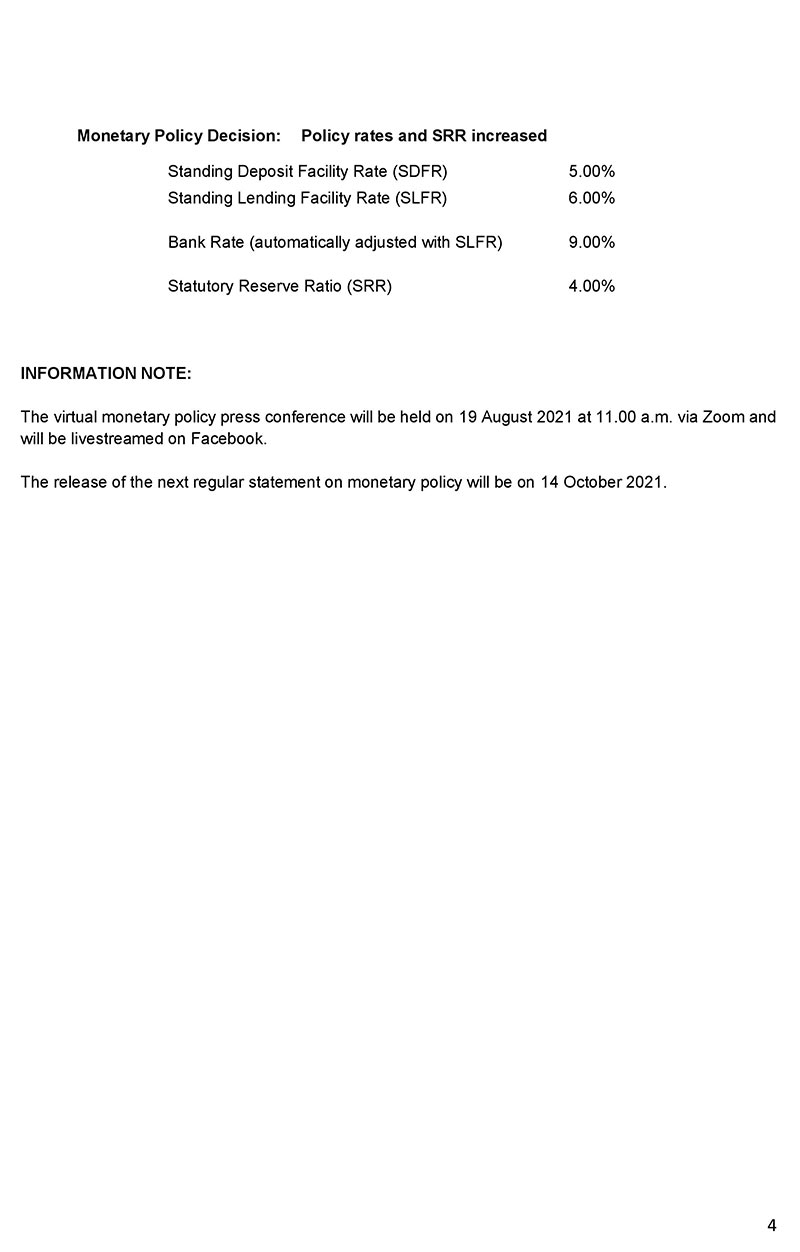

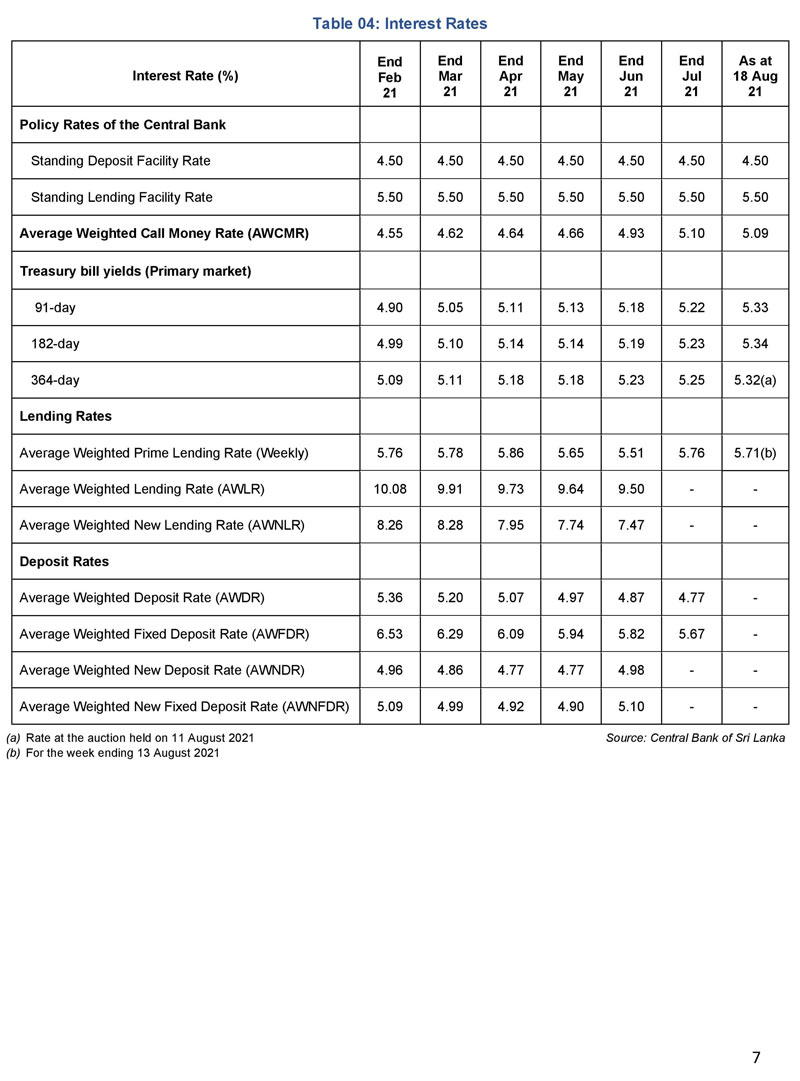

The Monetary Board of the Central Bank of Sri Lanka (CBSL) has decided to increase the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank by 50 basis points each, to 5.00 per cent and 6.00 per cent, respectively.

The decision was taken at its meeting held on Wednesday (August 18), the Central Bank said in a statement.

In addition, the Monetary Board decided to increase the Statutory Reserve Ratio (SRR) applicable on all rupee deposit liabilities of licensed commercial banks (LCBs) by 2.0 percentage points to 4.00 per cent, with effect from the reserve maintenance period commencing on 01 September 2021.

These decisions were made with a view to addressing the imbalances on the external sector of the economy and to preempt the buildup of any excessive inflationary pressures over the medium term, amidst improved growth prospects.

Full statement below:

Latest Headlines in Sri Lanka

- COPE uncovers irregular NMRA certification process March 14, 2025

- Anuradhapura Hospital Director removed following doctor’s assault March 14, 2025

- Popular rapper Shan Putha arrested with firearm March 14, 2025

- Batalanda commission report tabled in Sri Lankan Parliament March 14, 2025

- Female Grama Niladharis withdraw from night duty over security concerns March 14, 2025