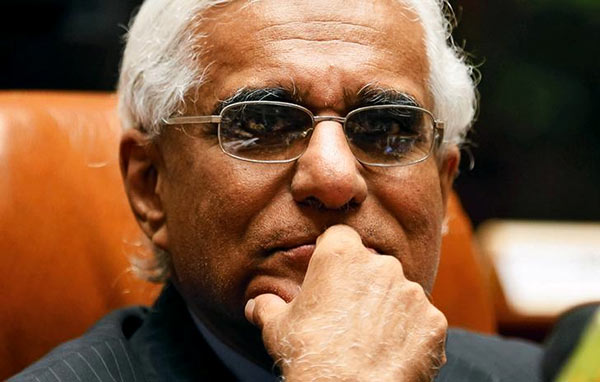

Current monetary policy appropriate to address prevailing imbalances in external sector: CB Governor

The Central Bank will maintain interest rates unchanged in order to defend the rupee and will use other methods to arrest the current volatile situation which stems from external pressures, Central Bank Governor Indrajit Coomaraswamy said yesterday.

The current interest rates in Sri Lanka which is around 8.5 percent is higher than other countries in the region. Therefore we have taken other measures to arrest the situation such as adjusting gold import duty, suspension of vehicle permits and restriction on non essential imports into the country,” Governor told the media announcing the Monetary Policy Review yesterday at the Central Bank auditorium.

He said that since imports have increased compared to exports, the CBSL decided to maintain policy interest rates at their current levels. Accordingly, the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the Central Bank will remain at 7.25 per cent and 8.50 per cent, respectively.

” The Monetary Board arrived at the above decision after carefully considering current and expected developments in the domestic and global economy, with the aim of stabilising inflation at mid-single digit levels in the medium term to support growth, ‘ he said.

Slow economic growth rate tight liquidity market and high interest rate promoted not to increase interest rate because local interest rates higher than other countries in the region. Since the US Federal Reserve increased their interest rates it is said that more than US $ 500 million gone out of the country, he said.

Governor Coomaraswamy said that if we increase interest rate its out come will have a negative impact on the economy such as will not be able to attract markets and will not have a direct impact on the interest rate for the rupee. Other countries such as India, Philippines and Malaysia increased their rates because those countries interest rates are lower than that of Sri Lanka, he said.

On September 12, overnight money was printed overnight at 7.93 percent.

Yesterday money was printed at an average of 8.19 percent to sterilize interventions, about 31 basis points below the rate that can be used to protect the rupee.

In response to the prevailing tight liquidity condition in the domestic money market, short term interest rates have adjusted upwards, while an uptick is observed in the yields on government securities in both primary and secondary markets, he said..

Credit extended to the private sector continued to decelerate buttressing the moderation of broad money growth in August 2018. These trends in monetary and credit expansion indicate greater monetary stability, which is consistent with the envisaged medium term growth path of the economy, he said .

Moreover, based on the data up to the first half of 2018, credit to all major sectors of the economy has expanded, indicating the availability of adequate financial resources to support economic activity.

The broad based strengthening of the US dollar subsequent to the increase in policy interest rates by the Federal Reserve and expectations of further interest rate hikes have exerted pressure on emerging market economies (EMEs). In response, he said ,

EMEs with significant pressure on local currencies have tightened their monetary policy stance by raising policy interest rates. Meanwhile, the recent upward trend observed in international oil prices is likely to exacerbate challenges faced by the global economy, he said.

(Source: The Island – By Hiran H.Senewiratne)

Latest Headlines in Sri Lanka

- FCID probes Wimal’s claims on Basil’s US assets January 3, 2025

- Thalatha Athukorala appointed UNP General Secretary January 3, 2025

- Ravindra Rammuni arrested for defaming MP Nilanthi Kottahachchi on Facebook January 3, 2025

- Yoshitha Rajapaksa arrives at CID for Kataragama land inquiry January 3, 2025

- Second inmate dies from tree branch fall incident at Matara Prison January 3, 2025

the governors do not reduce their perks such as pensions and also provident funds , free electricity, free water and would not demand free electricity and free water be given to the President Parliamentarians,Provincial Councillors , Local Council Members and our Judiciary for not going in accordance to article 126(5) and finishing a case filled in the Supreme Court within two months of filling a petition and for doing so they got a 3 fold increase . Also it can be stated from the data from internet it can be computed that even if we have 10 coal power stations the size of Norochoholai producing a total of 70 billion units per year, our per capita carbon emission per year will not exceed 70×109/21×106= 3040 Kg=3.04 metric tons assuming a population of 21 million and 1000Kg= a metric ton, as such there is no threat of carbon emission to our country by planning for accelerated coal power projects as many as required for our country. The President’s statements on climate change contravenes article 3,4,12, 27 anf 33 (f) of our constitution and as such direct foreign investors are avoiding us like a plague and also his reliance on solar power can be established has the biggest fraud committed in our country’s history which also has destabilized our country’s economy. This can be established from the following details given on energy sources of our country by clicking hpt//www.ceb.lk/yesterday

Reservoir Storage

947.9 GWh

Energy Percentage %

CEB Thermal (Coal) 11.6 GWh 29.51

CEB Thermal (Oil) 8.01 GWh 20.39

IPP Thermal (Oil) 2.27 GWh 5.77

Laxapana Complex Hydro 4.61 GWh 11.73

Mahaweli Complex Hydro 7.76 GWh 19.75

Samanala Wewa 2.13 GWh 5.42

Kukule Ganga 0.56 GWh 1.43

CEB (Small Hydro) 0.08 GWh 0.19

Wind 1.96 GWh 4.98

hpt//www.ceb.lk/yesterday this site appears to be hacked as there are very highly influential people involved in this solar power racket

There is no solar power in our country ‘s power sources but we have about 100 Mw of Solar power panels giving no kWh but paid at Rs.22 per kWh as such this is the biggest fraud in our country’s history going into several 100 Million US$ and the Presidents avoidance of coal fueled electricity has caused a loss of a trillion Rs. for the last 3 years and every days delay is causing a loss of a billion Rs. to we the people and our country would this have happened if these powers were given to parliament ?