IMF unveils 16-point plan to address governance challenges in Sri Lanka

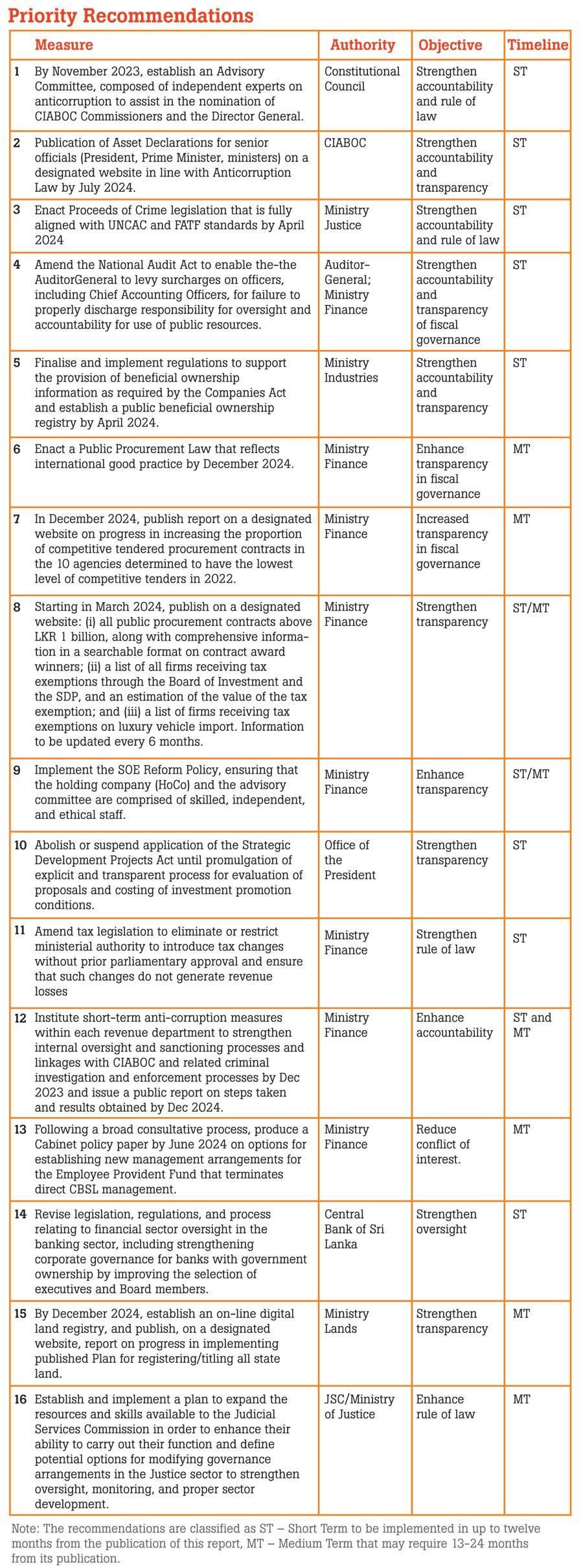

The International Monetary Fund (IMF) has recommended sixteen priority actions in its recently released Governance Diagnostic Assessment (GDA) on Sri Lanka to address systematic and severe governance weaknesses and deep-rooted corruption vulnerabilities across State functions in order to unlock the country’s growth potential.

Sri Lanka became the first country in Asia to undergo an IMF governance diagnostic under the global lender’s rescue package. Accordingly, an International Monetary Fund (IMF) mission undertook a governance diagnostic assessment from the 9th of March to the 31st of March this year.

The technical assistance report released last week revealed widespread corruption vulnerabilities and governance weaknesses originating from ad-hoc tax policy practices, half-baked approaches to Anti-Money Laundering/Combating Financing of Terrorism (AML/CFT), lack of a robust legal framework and poor processes utilised in SOEs, the absence of public procurement legislation, ad-hoc tax policy practices frequently modifying tax laws, conflict of interest concerns of Central Bank managing EPF and regulating NBIFs, and absence of clear mechanisms for information sharing among tax authorities.

Despite the widespread public outcry leading to mass protests and social unrest last year, the report pointed out that the authorities were yet to take action on recovering stolen funds, while civil society participation remains discouraged.

“Current governance arrangements have not established clear standards for permissible official behaviour, acted to deter and sanction transgressions, nor pursued individuals and stolen public funds that have exited the country. Regular civil society participation in oversight and monitoring of government actions is restricted by limited transparency, the lack of platforms for inclusive and participatory governance, and by the broad application of counter-terrorism rules,” it said.

GDA stressed that the impunity for misbehaviour enjoyed by officials continues to undermine trust in the public sector and compounds concerns over limited access to an efficient and rule-based adjudication process for resolving disputes, and hurts the integrity of the judiciary.

Although the new Anti-Corruption Act (ACA) is in force, it noted that key accountability institutions, including the Commission to Investigate Allegations of Bribery and Corruption (CIABOC), lack both the authority and competency to successfully fulfill their functions.

“Improvement brought about by the passage of the ACA needs to be complemented by the drafting and enactment of a modern law on Asset Recovery. Rapid operationalising of the ACA will be critical to address current corruption vulnerabilities associated with the lack of a functional system for receiving, publishing, and reviewing asset declarations by public officials, and procedural and competency issues in the investigation and prosecution of corruption cases,” it added.

Among priority actions, the GDA has recommended the government abolish or suspend the application of the Strategic Development Projects Act until the promulgation of an explicit and transparent process for the evaluation of proposals and costing of investment promotion conditions.

“There is no definition of what criteria need to be satisfied for a project to be of strategic relevance, and the revenue forgone from such projects is not systematically contrasted against their potential benefit in a transparent process. Crucially, the Department of Fiscal Policy (DoFP) is not involved in the selection or evaluation of projects, and any data that may exist is not shared with the department. While the specific concessions given to companies benefiting from provisions of the SDP Act differ, the revenue consequences are likely significant,” it pointed out.

It noted that a holistic, impartial, and transparent analysis is required to decide whether a specific project is viable and whether the potential benefit exceeds its social costs – which include revenue forgone, an increase in administrative costs, market distortions, and potentially perceptions of unfairness.

“While the BoI is likely well-positioned to understand the investment potential of specific projects, it lacks an understanding of the wider fiscal framework and budgetary needs which are necessary to evaluate the net social value of a specific project. The DoFP should evaluate and guide the design of all tax incentives, including those based on the SDP Act and the Port City Act,” it added.

The analysis also scrutinized the high corruption vulnerabilities in public procurement due to the absence of a procurement law, which has led to high levels of political engagement in the selection of procurement winners, poor contract management, limited transparency, and a number of other issues. Hence, it has been suggested to enact a Public Procurement Law that reflects international good practice by December next year.

In addition, it was highlighted that the lack of information on beneficial ownership of companies increases the risk of conflicts of interest in the awarding of contracts.

While anti-money laundering mechanisms have the potential to reduce corruption vulnerabilities, the report was critical of current approaches to Anti-Money Laundering/Combating Financing of Terrorism (AML/CFT), which has largely failed to support effective state action.

“Issues in legal definitions and processes to capture and share information on the beneficial ownership of companies have not been addressed, since they were first observed in 2015.

Current practices by financial institutions largely fail to identify suspicious transactions and prevent money laundering. At the same time, weaknesses in the legal framework, problems in domestic cooperation on corruption-related issues between competent authorities, and issues in establishing effective protocols for collaboration with foreign jurisdictions impair sanctioning corrupt officials for money laundering offenses or recovering stolen assets,” it added.

Meanwhile, it also highlighted governance weaknesses associated with increased risks of corruption around Contract Enforcement and Property Rights, which has constrained private sector development.

“Multi-year waiting times for the resolution of contract disputes prevent reliance on courts for effective and fair resolution of disputes and encourage disputants to find ways, not always legal, to speed up adjudication. Widespread confusion over the allocation of property rights and the lack of progress in digitizing property records generate extensive long-term legal disputes and similarly promote resort to opaque means to influence the resolution of disputes.

Corruption risks around state-owned land, estimated at approximately 80 percent of the country, are particularly severe due to the combination of lack of clarity around titles, the absence of a property registry, and ambiguity in processes for the divestiture of state property,” it elaborated.

As a result, it noted that the integrity of the judiciary has eroded over time and private parties have moved to use illicit payments to resolve disputes.

“…the strong incentives of private parties to use illicit payments as a way to solve legal problems that have little chance of being resolved in the near term, and have focused attention on the need to strengthen the independence and competency across the legal sector,” it added.

The recommendations are expected to contribute to the formulation of governance and anti-corruption policies and programmes, improvement of the legal and institutional frameworks, as well as governance and anti-corruption reform measures agreed to in the Staff Level Agreement for an Extended Credit Facility Arrangement for Sri Lanka.

As a result, it noted that the integrity of the judiciary has eroded over time and private parties have moved to use illicit payments to resolve disputes.

“…the strong incentives of private parties to use illicit payments as a way to solve legal problems that have little chance of being resolved in the near term, and have focused attention on the need to strengthen the independence and competency across the legal sector,” it added.

The recommendations are expected to contribute to the formulation of governance and anti-corruption policies and programmes, improvement of the legal and institutional frameworks, as well as governance and anti-corruption reform measures agreed to in the Staff Level Agreement for an Extended Credit Facility Arrangement for Sri Lanka.

(Courtesy: Daily Mirror)

Latest Headlines in Sri Lanka

- CID raids Kataragama Basnayake Nilame’s house in search of IGP Deshabandu March 10, 2025

- Sri Lanka’s remittance inflows continue to grow in February 2025 March 10, 2025

- IGP Deshabandu Tennakoon seeks court order to block arrest March 10, 2025

- Chamal Rajapaksa to contest Local Government Elections under SLPP March 10, 2025

- Aloe Blacc arrives in Sri Lanka to explore investment opportunities March 10, 2025