Sri Lanka panel questions central bank chief over bond sale

A Sri Lankan commission investigating irregularities in government bond sales questioned the new head of the country’s central bank on Tuesday, as the government’s anti-corruption policy came under scrutiny.

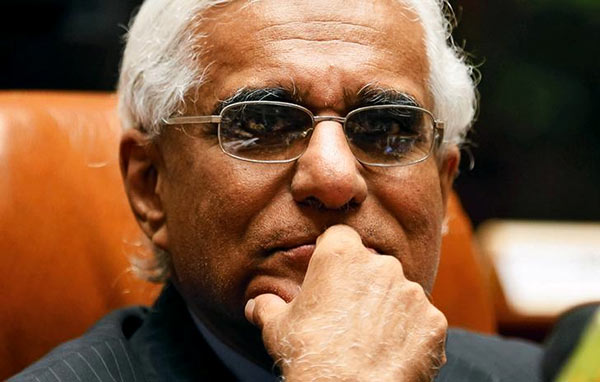

The commission questioned Indrajith Coomaraswamy on the alleged irregularities in the issuance of treasury bonds. It will also investigate a controversial bond sale under his predecessor, Arjuna Mahendran, in February 2015.

Coomaraswamy, who was appointed by President Maithripala Sirisena on July 4 after Mahendran’s tenure ended, was questioned for nearly three hours on Tuesday by the commission, according to a Reuters witness at the commission office.

Sirisena appointed the commission after opposition lawmakers demanded an independent inquiry, charging that the controversial bond sale has lost the state more than $1 billion because of rising borrowing costs in the past two years. The central bank has dismissed the opposition’s claims.

Civic organisations that back Sirisena have demanded the president ensure an independent investigation.

“We have a big hope on this commission,” said Keerthi Tennakoon, an advisor to Anti-Corruption Forum (ACF), a local body which has highlighted many irregular deals under Sirisena.

“We are happy the way the central bank is cooperating on this investigation and we believe the truth will be revealed.”

Less than two months after he ousted Mahinda Rajapaksa in 2015, President Sirisena’s administration faced criticism over a February 2016 bond auction that forced government borrowing costs up by 2 percentage points.

The auction originally intended to sell 1 billion rupees ($7 million) of 30-year bonds. It eventually grew to more than 10 times that amount, to meet government borrowing needs.

More than half of the issue was sold to Perpetual Treasuries, a subsidiary of a company owned by the son-in-law of the former central bank governor, Mahendran, in what has been criticised as a conflict of interest.

Mahendran, appointed by Prime Minister Ranil Wikremesinghe, and his son-in-law, Arjun Aloysius, deny wrongdoing.

Coomaraswamy earlier this month told reporters the central bank has taken some action against Perpetual Treasuries after preliminary investigations, but he declined to elaborate on the actions taken.

Officials at the Perpetual Treasuries have denied any wrongdoing in the past.

(Reuters)

Latest Headlines in Sri Lanka

- CID raids Kataragama Basnayake Nilame’s house in search of IGP Deshabandu March 10, 2025

- Sri Lanka’s remittance inflows continue to grow in February 2025 March 10, 2025

- IGP Deshabandu Tennakoon seeks court order to block arrest March 10, 2025

- Chamal Rajapaksa to contest Local Government Elections under SLPP March 10, 2025

- Aloe Blacc arrives in Sri Lanka to explore investment opportunities March 10, 2025

The white-haired Granpa is in trouble.

He has to protect his predecessor (the Ealamite) and also show his his new Sinh Buddhi masters that he is an impeccable professional.

C’mon Granpa, retire and go work for the World Bank if you want to.

Leave the CBSL to political appointees who will dance to the merry tune of the political leaders and load their off-shore accounts with foreign reserves !

I know not much about the sale of bonds but i may not to wrong to assume that there is procedure laid down that is to be followed by those involved in the trade bonds and most like they need to go through several security checks before final authorisation probably by the head any dubious applications would be held back for further scrunity before they are rejected. Questioning the governor is meaningless. Any suspicion activity should be investigated by the internal audits. Informal inquiries are meaningless without any objective.

Surely Mahendren would have followed the methodology adopted for Central Bank Bond issues in central banks in asia and as such is this a media blitz that most people think he is guilty of a fraud and did not his son in law resigned as the CEO of perpetual treasuries before Mahendren took over as governor of the central bank