Sri Lanka secures $5 Billion savings in debt restructuring, aims for economic revival

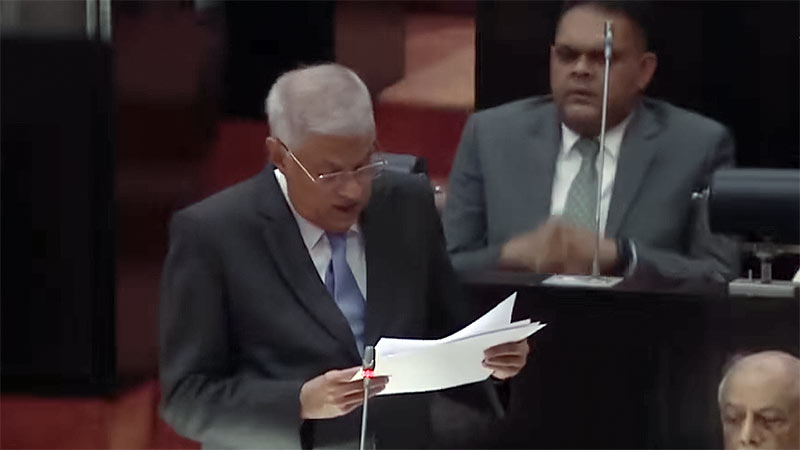

Sri Lanka is set to save $5 billion in interest payments to bilateral creditors through its debt restructuring process, Sri Lankan President Ranil Wickremesinghe announced today (July 2).

According to Reuters, President Wickremesinghe stated that these savings will be used to bolster dollar reserves and support economic growth.

The financially struggling South Asian nation recently reached agreements with China and other creditor countries to restructure approximately $10 billion in bilateral debt, following 15 months of negotiations, Wickremesinghe informed parliament.

These agreements mark significant progress towards concluding a debt restructuring process that began in September 2022, after Sri Lanka’s foreign exchange reserves plummeted, leading to its first-ever default on foreign debt.

“Sri Lanka gains multiple benefits from this agreement. The repayment period has been extended by eight years to 2043, and interest rates have been adjusted to 2.1% or less,” Wickremesinghe said.

“The country stands among middle-income nations that have successfully navigated the debt restructuring process in such a brief timeframe.”

Negotiations with bondholders to restructure $12.5 billion in debt are advancing well, with a resolution anticipated soon, Wickremesinghe noted as he initiated a two-day parliamentary debate on the restructuring process.

Sri Lanka, with a total external debt of $37 billion, also needs to finalize restructuring arrangements for $2.2 billion owed to the China Development Bank, according to the latest finance ministry data.

This debt restructuring effort is supported by a $2.9 billion International Monetary Fund (IMF) program, providing Sri Lanka an opportunity to restore debt sustainability, improve public services, increase reserves, and lower domestic interest rates, Wickremesinghe added.

Upon completing the entire debt restructuring process, Sri Lanka aims to reduce its debt burden by $16.9 billion.

The central bank forecasts a 3% economic expansion for Sri Lanka in 2024, following a 2.3% contraction last year.

Latest Headlines in Sri Lanka

- Sri Lankan President orders swift livelihood restoration for disaster-hit communities December 13, 2025

- Sri Lanka receives over USD 7 Billion in remittances in 2025 December 13, 2025

- Sri Lanka Parliament summoned to meet on December 18 December 13, 2025

- Sri Lanka and Italy renew agreement on mutual recognition of driving licenses December 13, 2025

- Asoka Ranwala granted bail December 12, 2025